Exploring the Potential of Sports Betting Algorithms

Written on

Chapter 1: Introduction to Sports Betting Algorithms

In this article, we delve into the intriguing realm of quantitative sports betting, focusing on a recent algorithm designed to forecast game outcomes.

The Westgate Sportsbook in Las Vegas has been a focal point for many bettors. Recently, I began developing an algorithm intended to accurately predict the winners of games. This model achieved an impressive accuracy rate exceeding 60% over 20 years of historical data. However, relying solely on game winners proved unsustainable after factoring in sportsbook fees, prompting me to make adjustments to improve the system's performance.

For a comprehensive understanding of the algorithm's framework and how predictions and odds function, you can read more here: My Sports Betting Algorithm Might Be Bringing In Serious Dollars. In this discussion, I will focus on an experimental modification to the system that embraces a more proactive methodology.

Section 1.1: The New Approach

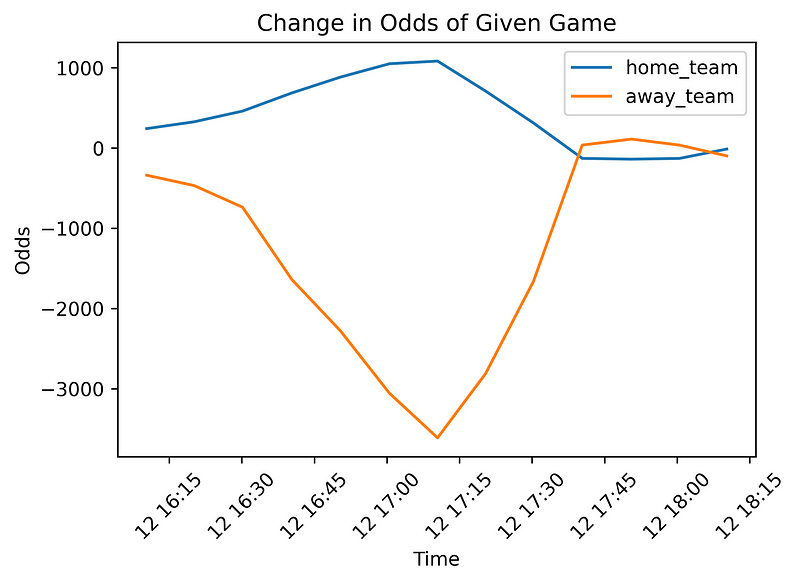

The revised system is straightforward: Prior to each match, we utilize the established model to predict the winner and assign a probability. During the match, we monitor changes in the odds provided by sportsbooks every minute. If, within the first hour, we observe a significant shift in the odds indicating our initial prediction might be incorrect, we proceed to place a bet on our original choice at the newly improved price.

Let’s illustrate this with an example:

Imagine a game where the New York Yankees are up against the Boston Red Sox. Our algorithm predicts that the Red Sox have a 70% chance of winning, and the sportsbook reflects this with odds of -250 (equivalent to a 70% probability). This means a wager of $250 is required to yield a $100 profit. If, within the first hour, the Red Sox find themselves trailing 0-3 and their chances of winning drop to 50% (odds of -100), we would then place our bet.

We opt for a 1-hour time frame because, in a typical 3-hour Major League Baseball game, if our team is down with only half an hour left, their chances of a comeback are slim. Additionally, most sportsbooks cease accepting new bets in the closing minutes of a game.

This active strategy aims to mitigate the impact of the sportsbook's "vig." Betting $250 to earn just $100 means that a single loss can erase the profits from two wins. While this might be manageable if you place bets occasionally, it can lead to significant losses over time.

The dynamics shift dramatically when we begin securing "better" prices. If an event has a 70% likelihood of occurring, but the odds suggest only a 50% chance, we are making a positive expected value (EV) bet, which can lead to sustainable profitability in the long run.

Section 1.2: Evaluating the Results

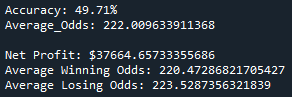

This backtest adhered to the aforementioned strategy, with fixed bet sizes of $100 for each wager, utilizing data from the 2022 MLB season spanning April to October. Below are the findings:

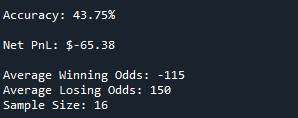

Unfortunately, the results did not meet expectations. This underwhelming performance is likely attributed to the sportsbooks' efficiency. Even when the predicted team's chances of winning diminish, the odds offered by the sportsbooks do not decrease significantly. Typically, mid-game changes may shift odds from -150 to -125, which, while slightly better, still fall short of our target. The aim is to secure positive odds (e.g., +110, +150), ensuring that each bet yields greater returns than the initial stake.

Notably, the accuracy of predictions dropped considerably (from 60%), which underscores the sportsbooks' proficiency in adjusting odds based on real-time performance. When they begin to adjust prices anticipating that the initially favored team may lose, they are often correct.

In summary, this method resulted in a negative long-term expected value. The calculation is as follows:

(amount won * winning percentage) + (amount lost * losing percentage)

For our example:

(86.96 * 0.44) + (-100 * 0.56) = -17.74

(Here, 86.96 represents the profit from winning bets at odds of -115 with a $100 stake.)

As long as the outcome of this formula is negative, the system is not viable for long-term use.

Chapter 2: Future Directions and Conclusion

This case study serves as a foundational exploration of active, automated sports betting systems. Much like stock trading, a diverse strategy is preferable, featuring a variety of bet types rather than relying on just one.

The next phase of this project will involve a multi-asset approach, where the system identifies the most advantageous combination of bets for a given day. Imagine running our original model not only for game winners but also for totals (bets on the aggregate score), spreads (the margin of victory), and more, allowing the program to suggest the most confident bet in each category.

If you are interested in tracking the system's development or want to learn more about these strategies, visit The Quant’s Playbook, where I share in-depth analyses on actionable and profitable betting methods!

Happy betting! :)

This video discusses how to cultivate wealth through sports betting by adopting seven key habits.

In this video, learn strategies that could potentially yield a million-dollar profit from sports betting.