# Essential Insights Before Investing in NFTs: A Comprehensive Guide

Written on

Chapter 1: Market Overview

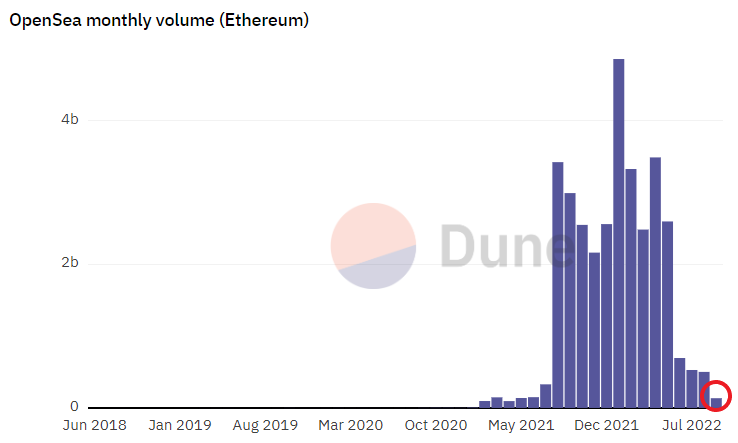

Understanding the NFT market is essential before making any purchases. Recently, popular NFT marketplace Opensea recorded just 2.7% of its monthly sales compared to its peak in May 2021. This sharp decline reflects a broader market downturn, with many existing projects losing value and new launches struggling to sell out.

Here’s a closer look at the data.

According to Dapp Radar, Opensea's sales volume was $7.83 million in Ethereum NFTs on September 11, 2022. In stark contrast, just a year earlier, on May 1, 2021, the volume reached an astounding $405.74 million. Historical events, such as the 2017 ICO crash and the Dotcom bubble, suggest that such downturns were foreseeable.

For newcomers to the NFT landscape, this may present a favorable buying opportunity. Dune Analytics indicates that Opensea has generated $135.9 million in sales for September 2022, compared to a staggering $4.85 billion in January 2022.

This recent market correction is a necessary step. The influx of low-effort NFT projects, often led by inexperienced founders, has created unrealistic expectations. Despite the current turmoil, understanding key principles can guide you effectively in your NFT purchases.

Section 1.1: Strategic Buying Tips

Buy the Floor or the Top-Tier NFTs, Not the Mid-Tier

Investing in mid-tier NFTs can often be the least rewarding choice. Researching collectibles reveals that early market movements typically favor entry-level items as new investors seek initial exposure to a project. As the Web3 ecosystem matures, collectors tend to gravitate towards rarer, higher-value items, leaving mid-tier tokens at risk of price stagnation.

For the time being, consider avoiding mid-tier tokens until the market stabilizes and new projects can establish their value.

Subsection 1.1.1: Avoid Price Anchoring

Missing out on minting a project for 0.35 ETH while finding it available on the secondary market for 0.5 ETH can still be a worthwhile opportunity, provided you believe in the project's long-term potential. Web3 encourages us to think more like venture capitalists and less like traditional consumers.

Many individuals regretted not minting VeeFriends season 1 for 0.5 ETH, especially when they could have bought a floor token at 0.75 ETH. The floor price soared to 23 ETH, representing a significant investment for most people aware of the project.

From my experience, it's important to avoid FOMO (fear of missing out). It's perfectly acceptable to pay a slight premium on the secondary market and adopt a long-term perspective. A price point that seems affordable today may become a dream exit in a few years.

Follow me for more insights on Medium, LinkedIn, or Twitter.

This article serves informational purposes and should not be taken as financial, tax, or legal advice. Always consult a financial professional before making major financial decisions.

Chapter 2: Insights from Experts

In the video "What the Heck Is an NFT? (And Should I Buy One?)", experts break down the basics of NFTs and provide insights into whether investing in them is worthwhile.

The video "You've Actually Been Buying Into the Idea of NFTs for Years Without Even Knowing It" explores how the concept of NFTs has permeated our lives, often without our realization.