Anchor Protocol: A New Era of Savings in DeFi

Written on

Chapter 1: Introduction to Anchor Protocol

The decentralized finance (DeFi) landscape is witnessing rapid evolution. Unlike traditional financial systems, the cryptocurrency market has demonstrated the potential to enhance various financial aspects for users rather than banks. Anchor Protocol serves as a decentralized, permissionless DeFi application that connects individuals seeking stable, low-risk returns on their UST deposits with those looking to borrow funds against collateral. Essentially, Anchor Protocol aims to establish a reliable "anchor" in your financial journey, which could be pivotal in popularizing DeFi.

Chapter 1.1: Mechanism of Anchor Protocol

Anchor operates on the Proof-of-Stake (PoS) blockchain model, where validating transactions requires users to stake cryptocurrencies. Validators risk losing their staked assets if they act maliciously during the block confirmation process.

Key components of Anchor include:

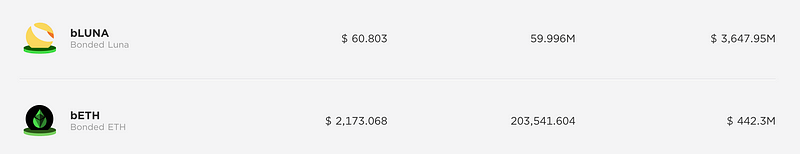

- bAssets: These are the liquid forms of staked cryptocurrencies, currently supporting bLUNA and bETH. Unlike traditional staking, where assets become illiquid, bAssets allow users to maintain capital efficiency.

- Money Market: A pool of UST stablecoins, sourced from individuals who provide capital for others to borrow.

Chapter 1.2: User Types and Benefits

Anchor caters to two user categories:

- Users depositing UST into the money market for approximately 20% APY.

- Users providing bAssets as collateral to borrow UST.

The unique strength of Anchor lies in its acceptance of bAssets as collateral. These assets guarantee a consistent yield from staking, thus ensuring a stable income flow for the protocol, which incentivizes its use.

Anchor Protocol Full Beginner Guide For 20% APY (2022): Step By Step Tutorial - This video provides a comprehensive guide for beginners looking to understand how to earn 20% APY using Anchor Protocol.

Chapter 1.3: Income and Outflow Dynamics

Anchor generates income primarily through two channels: the staking returns from bAssets and the interest paid by borrowers. The protocol’s inflow comprises these two income streams, while the outflow reflects the interest paid to UST depositors.

Chapter 2: Earning Opportunities with Anchor

There are several avenues through which users can earn with Anchor:

- Deposits: The simplest method to earn money is by depositing UST, which the project markets as a savings product with a 20% APY.

- Borrowing: Users can borrow UST by offering bAssets as collateral, with the potential to earn ANC tokens as a reward, which typically surpasses the loan interest.

- Staking ANC: Users can purchase and stake ANC tokens to earn rewards and engage in governance. Current APR for staking is available on the platform.

- Providing Liquidity: Users may also earn rewards by supplying liquidity for ANC by staking ANC-UST LP tokens.

BULL MARKET THROWBACK: How to earn fixed interest (20%) on UST using Anchor Protocol - This video explains how users can benefit from fixed interest rates on UST deposits through Anchor Protocol.

Chapter 2.1: Understanding the Anchor Rate

The protocol comprises three main components: ANC token incentives/governance, money markets, and diversified staking yields:

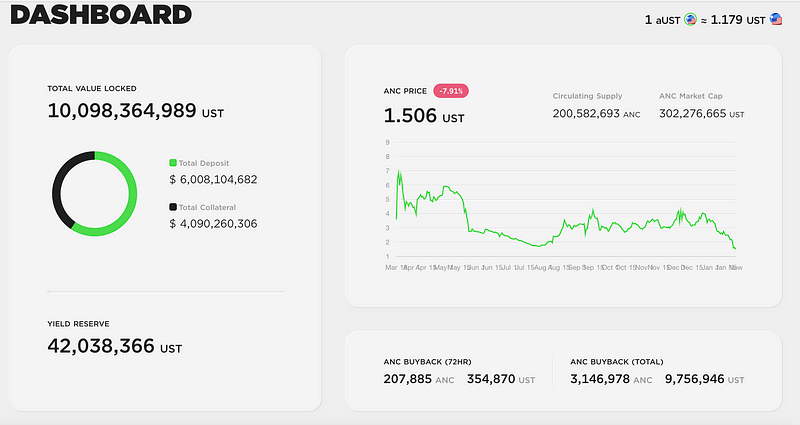

- Anchor Rate: This is the target APY that Anchor aims to provide to depositors. The governance mechanism adjusts this rate based on community votes.

- Real Yield: This refers to the earnings generated through collateral that allows for staking rewards, forming a part of the actual yield.

The Anchor Rate adjusts in two scenarios:

- When the Anchor Rate exceeds the real yield, ANC incentives for borrowers increase by 50% weekly until equilibrium is achieved.

- When the Anchor Rate is lower than the real yield, a yield reserve is created to store surplus yield in UST.

Chapter 3: History and Future of Anchor

Anchor is a Terra-based application developed by Terraform Labs (TFL), aiming to integrate three core financial primitives: payments via UST, savings through Anchor, and investments via Mirror Protocol on the Terra blockchain. The initial objective was to bolster demand for Terra’s UST stablecoin by offering attractive yields to lenders, while also facilitating the integration of traditional finance with DeFi.

The Anchor Token (ANC) serves as the governance token for the protocol. It enables users to propose community pool expenditures, modify parameters, and vote on the inclusion of new collateral types. At inception, 150 million ANC tokens were distributed, with significant allocations going to LUNA stakers and the Anchor Community Fund.

Chapter 4: Conclusion

Anchor aims to revolutionize DeFi by introducing innovative features and striving to establish itself as the gold standard for generating passive income on the blockchain. It provides a seamless way to earn high returns on stablecoin deposits while offering security against market fluctuations. Given the ongoing growth and adoption of DeFi, Anchor Protocol is certainly a project to watch.

If you appreciate this content, consider supporting me as a writer by becoming a Medium Member for just $5 a month, granting you unlimited access to Medium. Sign Up here.

With appreciation,

Maximilian

Note: This article reflects the author's personal views and should not be interpreted as financial or legal advice. All information is sourced as of January 2, 2022, and is subject to change.